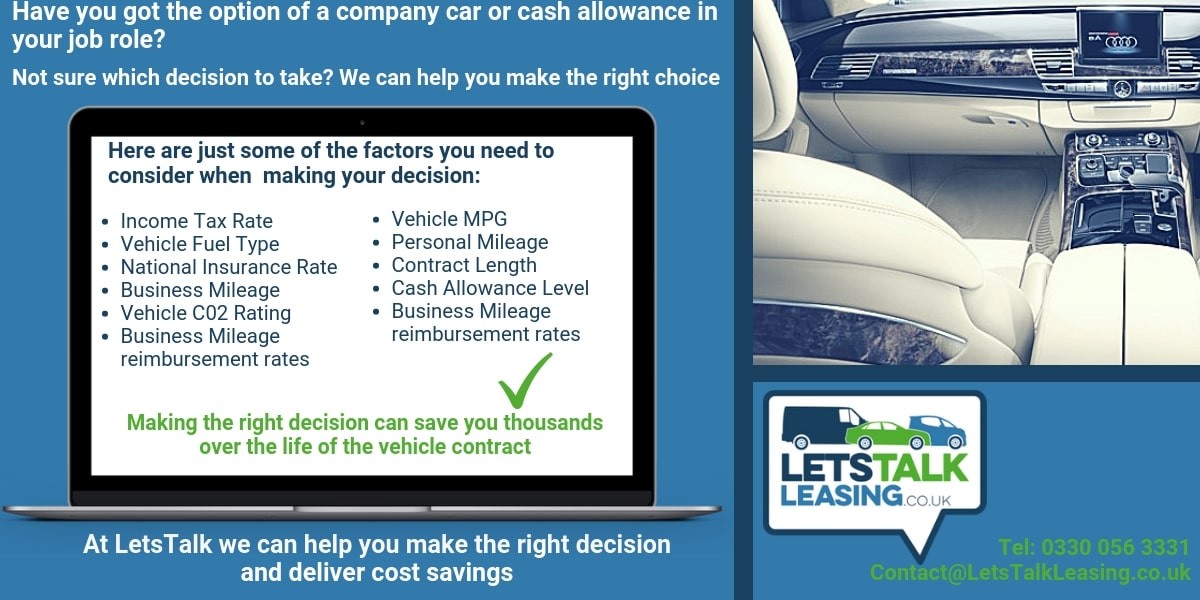

Company Car or Cash Allowance

Many businesses offer cash allowances either alongside or instead of a company car and given the recent significant increases in company car tax more and more employees are exercising their option and cashing out, our Fleet Consultancy Experts have summarised the factors both businesses and employees need to consider when making their decision.

Business Perspective

When setting cash allowances businesses need to decide what their strategy is and with the strategy clearly set should consider the following when developing your cash alternative:

Cash Allowance Level

Encourage company car take up - Many businesses want to keep drivers in company cars and will set cash allowances accordingly

Encourage cash take up - Increasingly popular solution given the rise in company car benefit in kind tax

Remaining cost neutral irrespective of the employee's decision - This effectively locks down the company's costs but still gives the employees choice

Mileage reimbursement decision - See below - The method chosen to reimburse business mileage will impact the level of allowance you should set

Mileage Reimbursement

Use Approved Mileage Allowance Payments (AMAP) - These tax free payments are used to reimburse business mileage undertaken in an employee's own car and are 45p per mile for the first 10,000 miles in a tax year and 25p per mile for each mile over 10,000, whilst the tax free status is attractive it can encourage unnecessary business miles

Use advisory fuel rates - These rates change regularly but are based on covering the cost of the fuel used and vary by fuel type and engine size, electric vehicle rates are now included at 4p per mile

Actual cost of fuel via fuel card - Use a fuel car to cover business miles

Private mileage taxation - Few company's offer this now due to the high tax burden on the employee

Vehicle Type & Usage

Vehicle funding options - Business car lease or buy decision for the company

Do employees need specific vehicles to undertake their role? - Could an employee source a suitable vehicle personally via their leasing options

Business miles undertaken - The higher the business mileage the higher the cost, more scope for tax free AMAP payments but the employee's personal vehicle costs will be higher

Personal mileage - This impacts the total cost of the company car

Vehicle cost - This impacts lease rate and tax costs

Vehicle Fuel Type - This impacts fuel and tax costs

Vehicle C02 rating - This impacts tax costs

Vehicle Miles Per Gallon (MPG) performance - Can be important depending on business mileage reimbursement rates used, consider Hybrid Car Leasing or Electric vehicle leasing to reduce fuel spend depending on your business requirements

Contract Length - How long are the vehicles kept for impacts total costs

Taxation

Corporation Tax - Rate impacts total business costs

VAT - 50% of Vat on capital element of the business car lease is recoverable for many businesses

Income Tax - Drivers income tax position influences their net spending power and company car tax

Employers National Insurance - Payable by the company on the company car benefit and on any cash allowance

Risk Management

Company Car - This gives the company visibility and control of the vehicle being used to ensure its fit for purpose, maintained and repaired

Cash Allowance - The company loses visibility of the actual car used but still has an obligation to ensure any vehicle used for business mileage is fit for purpose

Driving licence - Companies should check employee's licences for endorsements irrespective of whether the employee chooses cash or car

Employee Perspective

You need to decide if you want a car equivalent to the company car or something less/more expensive, having cash gives you more choice but you should consider all of the following before you make a decision:

Cash Allowance Level & Mileage Reimbursement

This will be set for you by the company its likely to be taxable but not pensionable earnings

Business mileage reimbursement may be at cost or via AMAP payments

Your net spend after tax will need to cover sourcing a vehicle, insuring, maintaining and repairing

Sourcing options include cheap car leasing options where you can source cheap car lease deals and you can use our car lease comparison tools to find your perfect vehicle Help Me Choose My Perfect Car

Vehicle Type & Usage

The vehicle you source personally needs to be compliant with your company policy and fit for business purposes

Business miles undertaken - Whilst the cost of fuel will be paid by the company these extra miles will increase the cost of your personal vehicle

Taxation

Company Car Tax - Use a company car tax calculator to ensure you are basing your decision on the right costs given the complexity

Income Tax - Your company car benefit in kind and cash allowance are subject to income tax

Employees National Insurance - You pay this on your cash allowance but not on a company car benefit in kind

Wrapping Up

With the numbers involved being typically ~£7,500 per employee per year the right decision is crucial to both the company and the employee, our team of Fleet Consultancy team can quickly model the answer based on your individual requirements whether you are the employer or the employee, if you would like us to take a look at your decision, Lets Talk!